Här kommer kalender för nästa år på Sri Lanka.

Kategoriarkiv: Business

Nyhetsbrev sweden-sri lanka business council

Det senaste nyhetsbrevet från Sweden-Sri Lanka Business Council har publicerats.

Länk till nyhetsbrevet; http://gantrack.com/t/pm/3999062428093/2428093/

SEB:s fondbolag investerar i grön obligation på Sri Lanka

SEB:s mikrofinansfonder samt Impact Opportunity-fonden har investerat 1,3 miljarder lankesiska rupier (cirka 66 miljoner kronor) i sin första gröna obligation. Pengarna ska finansiera gröna lån hos Pan Asia Banking Corporation i Sri Lanka.

30 juni 2020|12:25

SEB Investment management förvaltar idag sex mikrofinansfonder samt en bredare Impact Opportunity-fond med ett total kapital på drygt 9 miljarder kronor. Mikrofinansfonderna har tidigare finansierat Pan Asias utlåning till små- och medelstora företag.

– I och med SEB:s banbrytande arbete inom gröna obligationer är vi glada över att utvidga våra sociala investeringar till att även inkludera miljömässigt hållbara investeringar i Sri Lanka, säger Camilla Löwenhielm, portföljförvaltare inom mikrofinans på SEB.

Obligationen kommer att finansiera en ny låneprodukt ”Haritha Sammana” där Pan Asia erbjuder lån för nya gröna initiativ och projekt på Sri Lanka. Storleken på lånen som erbjuds ligger mellan 6 000-120 000 kronor med en löptid mellan 1 och 10 år.

– Sri Lankas jordbrukssektor är i stort behov av en omställning till ett mer hållbart jordbruk, ett arbete där Pan Asia spelar en viktig roll med produkter i framkant. Den nya låneprodukten kan till exempel finansiera klimatsmarta insatsvaror, användning av inhemska frön, solenergi och dropp-bevattning. Den förväntas även stärka små- och medelstora företag genom att erbjuda lån för solenergi- samt energieffektiva investeringar, säger Camilla Löwenhielm.

Hanna Holmberg, som började som portföljförvaltare inom Mikrofinans på SEB i mitten av maj understryker vikten av gröna obligationer och mikrofinansfonder för tillväxtmarknaderna.

– Den gröna obligationen gör det möjligt för en lokal kommersiell bank att få tillgång till långsiktig finansiering i lokalvaluta vilket är oerhört viktigt på tillväxtmarknader. Sen möjliggör gröna obligationer och mikrofinansfonder ytterligare inflöde av kapital som kan investeras i en mängd miljömässigt hållbara projekt som har en positiv ekonomisk och social inverkan på människors liv

SEB’s fund companies invest in green bonds in Sri Lanka

SEB’s microfinance funds and the Impact Opportunity Fund have invested 1.3 billion Sri Lankan rupees (approximately SEK 66 million) in their first green bond. The money will finance green loans from Pan Asia Banking Corporation in Sri Lanka.

June 30, 2020 | 12:25 PM

SEB Investment management currently manages six microfinance funds as well as a broader Impact Opportunity fund with a total capital of just over SEK 9 billion. The microfinance funds have previously funded Pan Asia’s lending to SMEs.

– With SEB’s groundbreaking work on green bonds, we are pleased to expand our social investments to include environmentally sustainable investments in Sri Lanka, says Camilla Löwenhielm, portfolio manager in microfinance at SEB.

The bond will finance a new loan product ”Haritha Sammana” where Pan Asia offers loans for new green initiatives and projects in Sri Lanka. The size of the loans offered is between SEK 6,000-120,000 with a maturity of between 1 and 10 years.

– Sri Lanka’s agricultural sector is in dire need of a change to more sustainable agriculture, a work where Pan Asia plays an important role with leading edge products. The new loan product can, for example, finance climate-smart input products, use of domestic seeds, solar energy and drip irrigation. It is also expected to strengthen small and medium-sized companies by offering loans for solar and energy-efficient investments, says Camilla Löwenhielm.

Hanna Holmberg, who started as portfolio manager in Microfinance at SEB in mid-May, emphasizes the importance of green bonds and microfinance funds for emerging markets.

– The green bond enables a local commercial bank to have access to long-term financing in local currency, which is extremely important in emerging markets. Then, green bonds and microfinance funds allow for additional inflow of capital that can be invested in a number of environmentally sustainable projects that have a positive economic and social impact on people’s lives.

Därför valde Nelly.com Sri Lanka för sin IT-utveckling.

I denna intervju med Henrik Palmquist, CTO på Nelly.com, berättar Henrik om varför Nelly valde just Sri Lanka för sin IT-utveckling. I slutet av denna artikel finner du även länk till videon med intervjun.

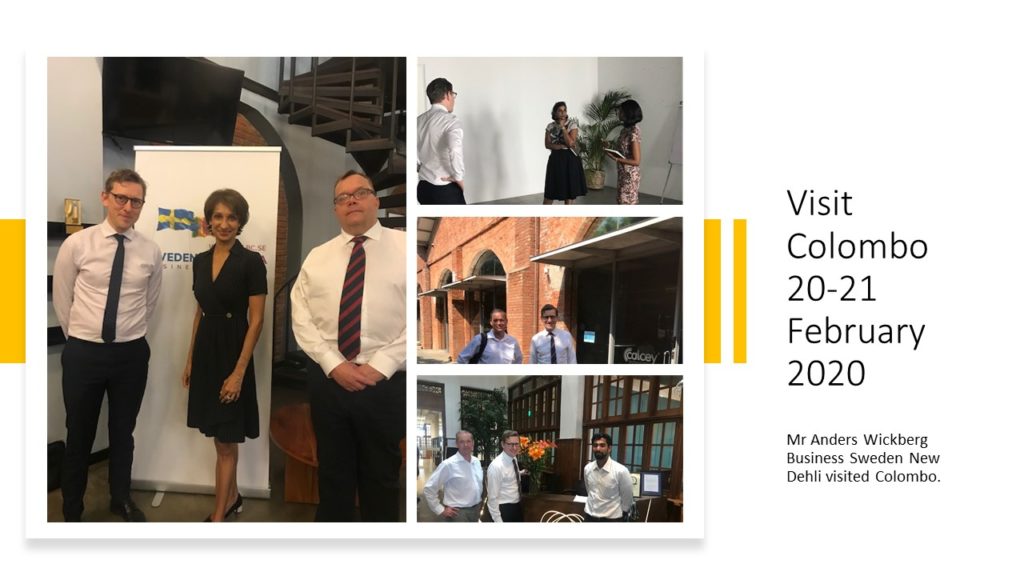

Besök från Business Sweden

Growing interest working with Sri Lanka from Swedish companies – Business Council meets in Colombo

Sweden-Sri Lanka Business Council (www.sslbc.se) hosted a visit (20-21 February) by the Trade Secretary Anders Wickberg from the Swedish Embassy in New Dehli.

The purpose of the visit was to get the newly appointed Trade Secretary acquainted with Sri Lanka and also meet Swedish and Sri Lankan companies with an interest of expanding the business between the two countries.

The visit included a visit to Trace City, Hatch incubator and Colombo Innovation Tower.

“Sweden being one of the most innovative countries in the world and with many start-ups and unicorns, plus that there are many Swedish companies who benefit from the Sri Lankan talent in the IT-field, these three stops are mandatory” says Leif I Ohlson (Secretary General for the business council).

On Friday SSLBC had invited the Trade Secretary Wickberg together with Sweden’s Honorary Consul General Otara Gunewardane to meet member companies. Therefore, hosted by council member mr Alexander Löwbäck (ikman.lk) some 25 people from Swedish and Sri Lankan members of the council had the opportunity to meet Mr Wickberg. Several various issues were raised all from investment climate in Sri Lanka to business visa procedures to Sweden and others which are a concern for the members. Mr Wickberg could inform about his work and Swedish priorities but also how the Swedish government export credit system works and can be of benefit for Sri Lanka exporters.

Secretary General Leif Ohlson ended the meeting with saying that “Sweden Is past, present and future partner to Sri Lanka. The visit by Mr Wickberg encourages both Swedish and Sri Lankan companies to work even harder for more investments and trade between the two countries.”

More information:

Secretary General Leif I Ohlson

077 071 66 52

Artikel i SvD om Sri Lanka

Journalisten Johan Mikaelsson besökte Sri Lanka i november 2019 för SvD:s räkning. Det blev ett fint reportage om Sri Lanka och vad som händer där, inklusive intervjuer med svenskar på plats.

Nyhetsbrev från Sweden-Sri Lanka Business Council

I det senaste nyhetsbrevet från Sweden-Sri Lanka Business Council (SSLBC) finns många intressanta artiklar med kopplingar mellan Sverige och Sri Lanka. Värd särskild uppmärksamhet är de om två svenska företag ABB och InnoVentum som var för sig gör fina affärer på Sri Lanka. Länk till nyhetsbrevet – här

Följ med på studieresa

Studieresa till Sri Lanka – så drar du nytta av landets IT kompetens!

Välkommen att deltaga i en effektiv studieresa under sakkunnig ledning. Syftet är att snabbt få en kunskap om möjligheterna på Sri Lanka för svenska företag som har behov av kompetens inom IT.

Reseledare och föreläsare

Leif I Ohlson, med mångårig kunskap från Sri Lanka, ordnar allt praktiskt, förklarar de kulturella skillnaderna och fördelarna med denna pärla i Indiska Oceanen.

Nils Molin, tidigare seniorrådgivare på Radar och författare till en rapport om Sri Lankas IT-industri, kommer att dela med sig av sina kunskaper om vad som är viktigast att tänka på.

Representant från kundföretag – på de flesta resorna medföljer även representant från något av de företag som valt Sri Lanka.

Info/fakta

Välj mellan 20-21 februari eller 24-25 februari

Flyg från Stockholm/Göteborg/Köpenhamn kostar c:a 7.500 kr.

Egen reseförsäkring krävs

Visum betalas av den enskilde -40 USD. Vi hjälper till med att söka (online).

Logi 3 nätter i Colombo kostar cirka 95 USD och uppåt – beroende på hotell.

Transporter i Colombo – ingår

Transporter utanför – egen bekostnad.

Vi kommer att vara en liten grupp för att säkerställa att du får det mesta ut av resan.

Ur programmet

- Nils Molin; ”Sri Lanka som värdeskapande offshoring destination”

- Så skapar du framgångsrik offshoring på Sri Lanka

- Extended team konceptet – hur fungerar det – träffa ett team!

- Presentation av Sri Lankas IT-industri (branschorganisation)

- IT utbildning på Sri Lanka

- Regeringens målsättning för utvecklingen av Sri Lanka’s IT industri

- En kund berättar om erfarenheter

- Sri Lanka-kunskap med Leif I Ohlson

- Egna möte med utvalda IT-företag.

Förläng gärna resan själv. Vi tipsar om bästa hotellen och platserna att besöka.

För mer info maila leif.ohlson@houseofsrilanka.se eller nils.molin@houseofsrilanka.se

Förläng gärna resan själv. Vi tipsar om bästa hotellen och platserna att besöka.

The Swedes started electric car companies in East Africa – expanding to Sweden

Google translated article that should be of interest for our Sri Lankan friends.

https://www.di.se/bil/svenskarna-startade-elbilsbolag-i-ostafrika-expanderar-till-sverige/

The Swedes started electric car companies in East Africa – expanding to Sweden

Swedish opener Opibus converts fossil-fueled safari cars to electric cars in East Africa. But now the company is going to broaden its operations and establish itself in Sweden. Read more here and see the interview with Filip Gardler, one of two CEOs at Opibus, in Di-tv Motor.

Opibus started rebuilding safari vehicles for electric cars in Kenya as late as 2018. The company also works with renewable energy and in building infrastructure for charging electric cars in the country. By 2021-2022, approximately 1,000 vehicle conversions will be made per year in East Africa.

But the safari industry is just an entry-level market. Now the company also builds motorcycles and works with charging infrastructure.

“There are around 1.2 billion vehicles in the world that are fossil-fueled. Replacing these with newly manufactured electric cars is neither financially nor resources justifiable. By converting to electric power, we instead see the existing vehicle fleet as a platform for more sustainable mobility, ”says Filip Gardler, one of two CEOs at Opibus.

In Kenya, the established car manufacturers have not invested in selling electric cars. But the local market exists.

“The region has been a dumping market for yesterday’s technology, not just in the automotive and transport industries. But thanks to lower maintenance and fuel costs, there is a great demand for electric cars. And then you are willing to compromise, with, for example, reach, to take advantage of the savings it entails to run on electricity. ”

Opibus uses lithium-ion batteries, but with iron phosphate and not cobalt, which is the most common in the automotive industry. The batteries used by Opibus have lower energy density, but on the other hand can withstand far more charge cycles.

Choosing a different battery chemistry means that the company is not affected by any component shortage in terms of batteries.

”We have a well-established partnership with our current supplier and have production lead times in just a couple of weeks,” says Filip Gardler.

Driving an electric car in Kenya is quickly becoming a profit business, both environmentally and financially.

”You have 80 percent renewable electricity in the energy mix and the country has an excess electricity thanks to the rapid growth of wind, solar and geothermal energy.”

Opibus expects within a year to make about 1,000 conversions on a yearly basis in Kenya.

”Authorities, politicians and the business community are very welcoming, you see opportunities for a technology boost, local production and a reduced need for oil imports,” says Filip Gardler.

A similar operation will soon be in place in Sweden as well. Now the company is looking for both staff and premises.

“We have long thought about how we can take on a slightly more mature market like Sweden. But we see that we can lower the cost of the transition to electrified transport here as well and create an alternative to new purchases of electric cars. ”

The basic price of a conversion from Opibus varies depending on the vehicle, but starts at SEK 100,000-150,000 and then you get a range of about 20 km, but if you want to build more battery capacity.

So far, the conversion industry is in its infancy, with a few startups in the world. But Filip Gardler believes the market will accelerate.

“I am absolutely convinced. For example, in our French partner company Phoenix Mobility, we received about 5,000 inquiries in a short time, without any marketing whatsoever. And, as I said, replacing the existing vehicle park with newly built electric cars cannot be done. It’s about reducing the cost barrier to reach new consumer groups and accelerate the sustainable transition, ”says Filip Gardler.